The Financing Process

Demystifying Home Loans

The home loan process can feel overwhelming

By collaborating with a trusted lender and remaining informed through every step of the process, from pre-approval to closing, you can have a significantly more comfortable experience. You’ll want to consult with a mortgage specialist (or two) to find a professional who you are confident will provide you with the best care. To get an idea of what to expect, review the following home loan process steps.

Churchill Mortgage

Mike Hardy and Rick Mount Team

Proudly Serving: Arizona, California, Texas, Idaho, Tennessee, Colorado, Florida, Nevada

About Mike Hardy & Rick Mount

Mike’s background includes 20+ years of experience in the securities, real estate, and mortgage markets. After graduating from Azusa Pacific University and before he began his career in lending, Mike was a respected Financial Advisor. Mike earned the Certified Mortgage Planning Specialist certificate (CMPS) and was recognized as a top 1% Loan Officer nationwide by Mortgage Executive Magazine for the last 10 years. With Churchill Mortgage, Mike and his partner Rick Mount are responsible for the Southwest marketplace, a $300 million annual region. Personally, he helped over 1000+ families make a smart and healthy financing decision. Mike is also a Certified Performance Coach helping Realtors and Mortgage professionals with personal and financial growth. Outside of work, Mike is also an accomplished athlete and has completed 10 marathons and recently completed his first full Ironman. Mike is a proud father of four children and has been married to his wife, Beverly, for 25 years.

Rick Mount has been serving his clients and referral partners in real estate and lending for over 25 years. He wants to ensure his clients choose the right mortgage through their Safe, Simple and Smart 5 step process. Rick has held many senior positions responsible for all facets of the loan process. Rick attended Cal State Long Beach, Cal Poly Pomona and Azusa Pacific University, all with an emphasis in Finance, Real Estate and Law. Rich has been licensed in California since 1992 and a licenses Broker since 2002. Away from real estate, Rick enjoys being with his family and hanging out by the water.

Mike Hardy and Rick Mount have been featured or referenced in Forbes, Fortune, USA Today, CBS, Yahoo Finance, CNBC, and Fox News for insights in mortgage and Real Estate markets. Mike and Rick have been national speakers addressing audiences for as many as 30k people at national Mortgage and Real Estate conferences, most recently speaking at the Keller Williams Family Reunion to the Real Estate Planner Community.

Step One:

Get pre-approval

Before you start looking for a home to buy, it’s wise and proactive to meet with a lender to get pre-approved for a loan amount. Offers accompanied by a pre-approval letter are stronger and will stand out, especially when the seller is receiving multiple offers.

To gain pre-approval, your preferred lender will gather information about income, assets, and debts to help determine how much you can borrow. This includes gathering a credit report, W-2 forms, pay stubs, federal tax returns, and recent bank statements.

There are a variety of home loan programs offering different advantages depending on your unique needs and preferences. Your preferred lender can go over the specifics of each to ensure you find a loan option that best aligns with your needs.

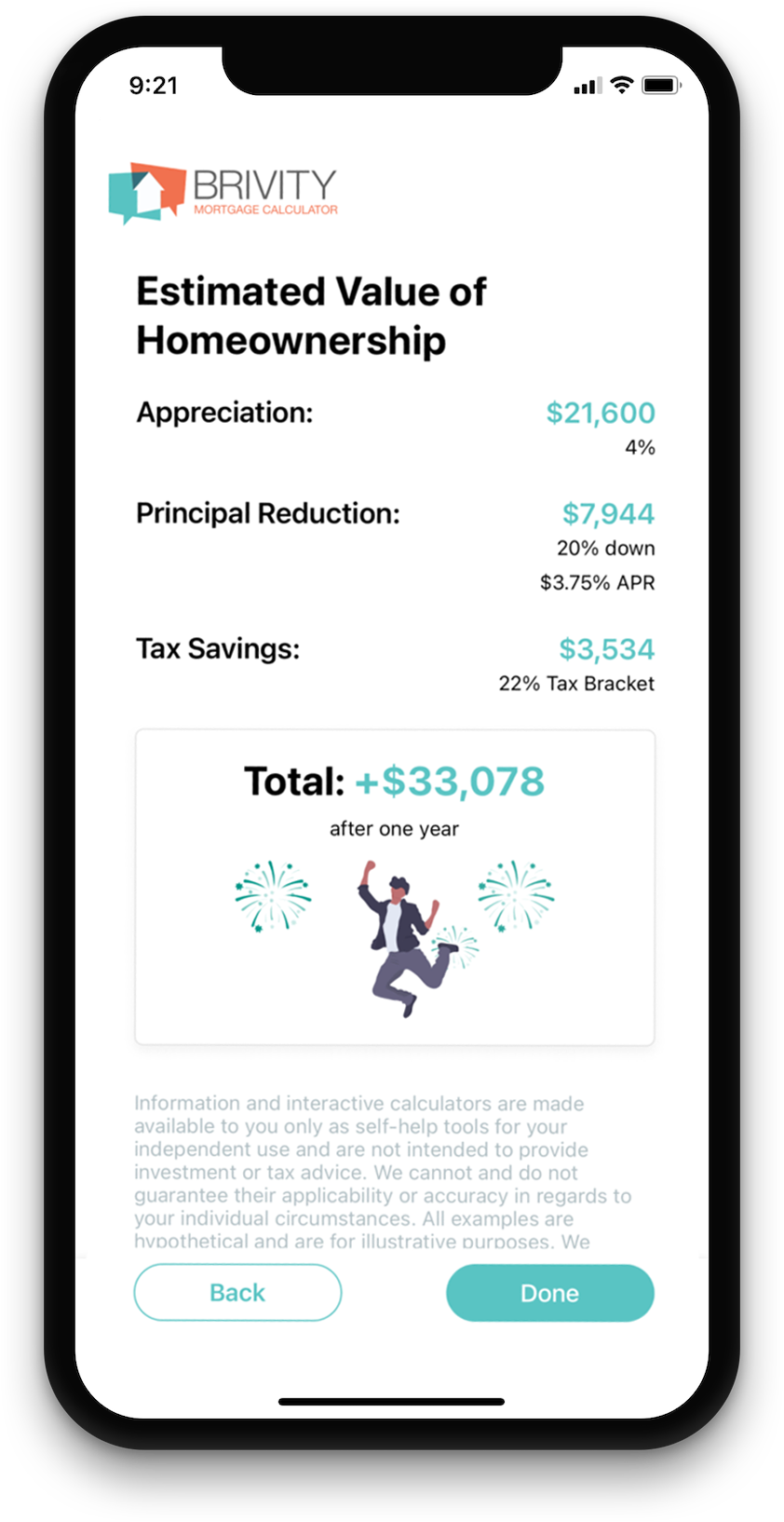

Estimate Your Monthly Payment

Estimate your mortgage payment, including the principal and interest, taxes, insurance, HOA, and Private Mortgage Insurance.

Price

Annual Tax

Loan Term (Years)

Down Payment %

Interest Rate %

Monthly HOA

Monthly Insurance

$3,198.20

Estimated Monthly Payment

Principal

$2,398.20

(75.0%)Taxes

$500.00

(15.6%)HOA

$100.00

(3.1%)Insurance

$200.00

(6.3%)Step Two:

Find the best loan

Collaborating with a top-notch local loan officer will ensure you have access to competitive rates and programs that best fit your individual needs. Take the first step by completing this form to get connected today!

Step Three:

Application and Processing

When you find the perfect property and your offer is accepted, your lender will help you complete a full mortgage loan application, discuss down payment options, and explain any related fees.

Then, your application is submitted for processing where the documents are reviewed. Your lender will also order a home appraisal and a property title search.

The next part of the application process involves sending everything to an underwriter who will review and approve the entire loan package to make sure it meets all compliance regulations.

It is not unusual to receive requests for additional documentation or clarification during this phase of the application process.

Step Four:

Signing and Finalizing the deal

Once your loan is approved, you’ll need to set up homeowners insurance.

Your documents will be sent to the title company and the closing will be scheduled for you to sign the necessary paperwork and pay any additional costs to complete the purchase of your new home.

After the loan goes through the required recording process, the purchase is complete, and you officially own your new home!